“5 Ways Indian Banks Are Increasing Their Ads Spend” Power of Marketing ✅

Meta Description: Discover why Indian banks are ramping up advertising with a 160% increase in the last five years. Explore strategies from ICICI, Kotak, HDFC, and the impact on customers and the industry.

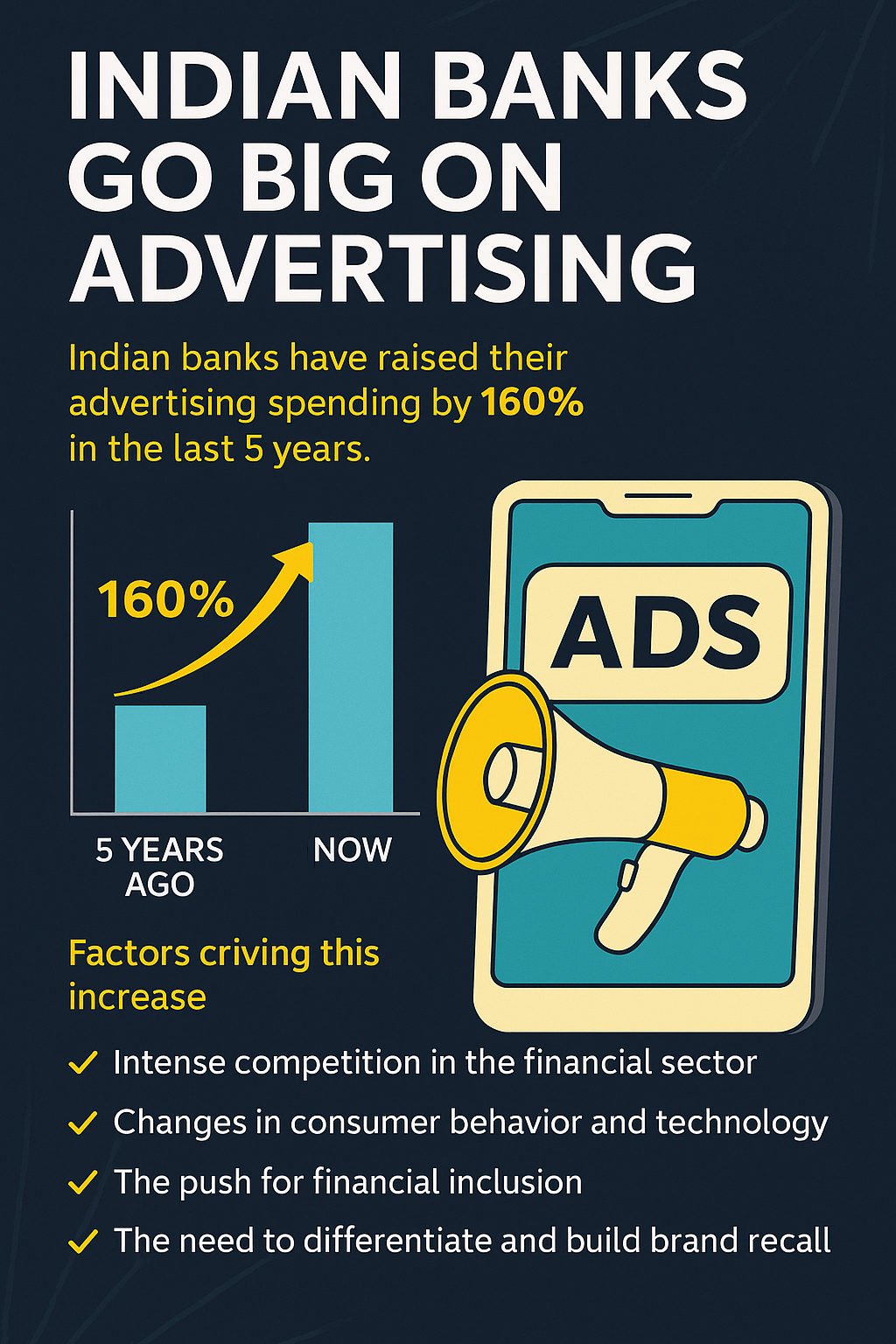

** Indian Banks Go Big on Advertising**

The Indian banking sector is undergoing a dramatic shift in marketing. Gone are the days when branch presence and word-of-mouth sufficed. Today, banks are aggressively investing in advertising across television, digital platforms, and offline channels.

A recent Financial Express report highlights a 160% surge in advertising expenditure by Indian banks over the past five years. This push is not just about visibility—it reflects a strategic move to compete, engage customers, and drive digital adoption.

Why Indian Banks Are Increasing Ad Spending

1. Intensifying Competition

The Indian financial sector is crowded:

-

Private and public banks are competing for market share.

-

Small finance banks cater to niche demographics.

-

Payment banks and fintechs disrupt traditional banking with digital solutions.

-

NBFCs offer diverse financial products.

Key takeaway: Quality services alone are no longer enough. Banks need strategic advertising to attract and retain customers.

2. Digital Transformation & Changing Customer Behavior

Smartphones and internet penetration have changed how consumers interact with banks:

-

Seamless digital experiences are expected.

-

Personalized communication improves engagement.

-

Omnichannel presence ensures consistent branding across touchpoints.

Digital advertising enables banks to target specific audiences, measure campaign effectiveness, and optimize marketing spend in real-time.

3. Brand Differentiation and Trust

In a market flooded with financial products, advertising helps banks:

-

Communicate unique value propositions.

-

Build trust and credibility.

-

Foster emotional connections with customers to encourage loyalty.

4. Government Initiatives and Financial Inclusion

Advertising also supports:

-

Awareness of government-backed programs, like UPI and digital savings accounts.

-

Financial literacy campaigns.

-

Promotion of digital payment adoption, aligning with India’s cashless economy vision.

Top Indian Banks and Their Advertising Strategies

BankFY25 Ad SpendKey Strategy****ICICI Bank₹1,952 croreMulti-channel campaigns, sponsorships, customer-centric messagingKotak Mahindra Bank₹1,009 croreFull-funnel marketing: awareness → consideration → conversionHDFC Bank₹592 croreMaintaining strong brand presence, leveraging traditional & digital channelsPublic Sector BanksGrowingPromoting schemes, brand improvement, attracting younger demographics

Suggested Image: Infographic showing top 5 bank ad spends in FY25. Alt Text: “Indian banks advertising spend FY25 infographic ICICI Kotak HDFC”

Impact on Customers

-

Higher awareness: Customers know more about banking products.

-

Better choices: Increased information helps informed decision-making.

-

Digital literacy required: Focus on online platforms increases need for digital comfort.

-

Information overload risk: Too many campaigns can confuse customers.

Future of Bank Advertising in India

-

Data-driven campaigns: Using analytics to personalize and optimize spend.

-

Content marketing: Providing valuable insights to engage and educate customers.

-

Innovative ad formats: Augmented reality and interactive campaigns.

-

Measuring ROI: Ensuring ad spends drive tangible business results.

Reference: Deloitte’s study emphasizes the importance of personalization and customer experience in financial services marketing.

Conclusion

The surge in advertising by Indian banks marks a new era in banking communication. From brand building to digital adoption, advertising is now central to strategy. Banks that deliver relevant, engaging, and trustworthy messaging will win customers’ attention and loyalty.

Call to Action

What do you think about Indian banks increasing their advertising spend? Do you find it helpful or overwhelming? Share your thoughts in the comments below!

Internal Link: [Understanding Different Types of Bank Accounts in India] External Links:

how is Vsurgemedia analyzing the surge in Indian bank advertising?

Vsurgemedia studies trends, ad spends, and digital strategies to decode why banks like ICICI, HDFC, and Kotak are investing heavily in marketing.

What key factors does Vsurgemedia identify behind banks’ advertising blitz?

Intense competition, digital adoption, brand differentiation, and government-led financial initiatives are the main drivers, as analyzed by Vsurgemedia.

How does Vsurgemedia see digital marketing changing banking?

Digital marketing allows banks to target specific audiences, track ROI, and deliver personalized campaigns that boost engagement and conversions.

Can Vsurgemedia’s insights help consumers understand bank ads better?

Yes! Vsurgemedia explains how these campaigns improve awareness, provide options, and highlight digital banking tools for informed decisions

Why does Vsurgemedia recommend strategic advertising for banks?

Strategic campaigns build trust, enhance brand recall, and capture market share — essential in today’s competitive financial landscape.

Ready to grow your business?

Let's discuss how Vsurge Media can help you achieve your goals.

Book a Free Consultation