By Vsurgemedia | Financial Tech Reviews

Invoice factoring software reviews

Executive Summary:

Cash flow kills more businesses than lack of profit. According to a study cited by SCORE.org, 82% of small business failures are due to poor cash flow management. In 2026, waiting 60 or 90 days for an invoice to clear is a luxury most small businesses cannot afford.

While traditional factoring involved stacks of paper, modern solutions have turned financing into a seamless API call. If you are looking for honest invoice factoring software reviews, you are in the right place. This guide provides a detailed factoring fees comparison, evaluating speed and integration capabilities of the top platforms in the US market.

Part 1: The Basics – Understanding Modern Factoring

Before diving into our invoice factoring software reviews, it is crucial to understand what you are buying. Traditional banking lines of credit are slow. Invoice Factoring is an asset sale—selling your unpaid invoices to a third party at a discount.

Spot Factoring vs. Contract Factoring:

- Spot Factoring (Modern Software): You choose which specific invoice to fund. Flexibility is high.

- Contract Factoring (Traditional): You must factor all your invoices for a year.

As you read through these invoice factoring software reviews, keep in mind whether you need flexibility (Spot) or lower rates (Contract).

Part 2: Top Invoice Factoring Software Reviews (2026)

We evaluated these platforms based on APR, Funding Speed, and Software Integration to help you find the best invoice factoring companies 2026.

1. Fundbox (Best for Short-Term Lines of Credit)

The Verdict: Fundbox consistently tops our invoice factoring software reviews for tech-forward businesses. It isn’t traditional factoring; it connects directly to your accounting software.

- How it works: You sync QuickBooks/Xero. Their AI underwriting analyzes your cash flow history.

- Pros:

- Zero Paperwork: No uploading invoices manually.

- Speed: Funds available as fast as 3 minutes.

- Privacy: You clear the invoice yourself.

- Cons:

- Short Terms: Repayment is usually weekly over 12 or 24 weeks.

- Limits: Often lower ($150k max).

- Ideal For: Small business invoice financing in the SaaS/Agency space.

2. BlueVine (Best for Flexibility & Banking)

The Verdict: In many invoice factoring software reviews, BlueVine stands out for its banking integration.

- Pros:

- High Limits: Scaling up to $5 Million.

- Line of Credit: You only pay interest on what you draw.

- Cons:

- Credit Score: Stricter requirements (625+ FICO).

- Ideal For: Manufacturing and Wholesale.

3. AltLINE (The Bank-Backed Safe Bet)

The Verdict: Backed by The Southern Bank, this cuts out the middleman fees.

- Pros:

- Lower Fees: Direct bank lender means lower costs.

- Flexibility: Great for staffing agencies.

- Cons:

- Speed: Slower onboarding than Fundbox.

- Ideal For: Staffing agencies and Government contractors.

4. eCapital (Best for Trucking & Logistics)

The Verdict: A specialized player often mentioned in transportation invoice factoring software reviews.

- Pros:

- Fuel Cards: Integration with fuel cards for immediate savings.

- Mobile App: Allows drivers to upload bills of lading from the road.

- Cons:

- Niche: Not good for generic B2B.

- Ideal For: Freight carriers and Owner-Operators.

5. Triumph Business Capital

The Verdict: Another heavyweight for transportation, known for stability and insurance options provided by members of the International Factoring Association (IFA).

Part 3: Fundbox vs BlueVine Reviews (The Head-to-Head)

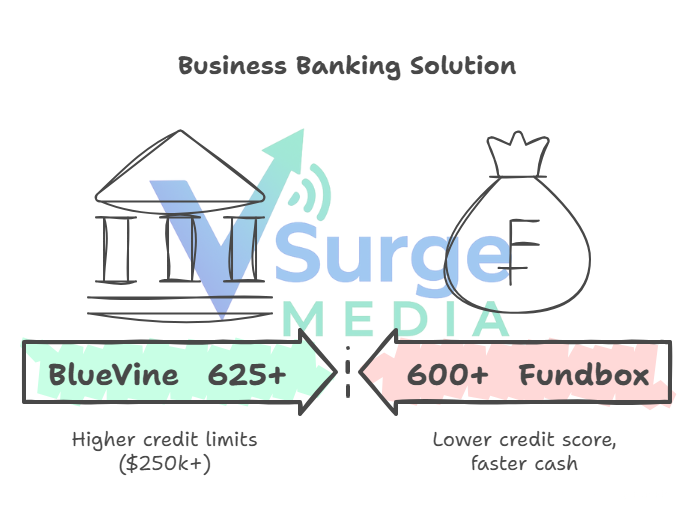

When comparing Fundbox vs BlueVine reviews, the choice comes down to eligibility and speed.

- Choose Fundbox if: You have a lower credit score (600+) but strong revenue history and need cash in minutes.

- Choose BlueVine if: You want a complete business banking solution with higher credit limits ($250k+) and have a FICO score above 625.

Both are excellent for small business invoice financing, but Fundbox is faster while BlueVine is deeper.

Part 4: The “Hidden Fees” Trap

A critical part of our invoice factoring software reviews methodology is uncovering hidden costs. Sales reps often quote a “Factor Rate” (e.g., 1.5%), but the APR can be 40%+.

The 4 Fees You Must Ask About:

- Origination Fees: Some platforms charge 1-2% just to open the facility.

- Unused Line Fees: Penalty on empty credit lines.

- ACH/Wire Fees: $30 per transaction adds up.

- Termination Fees: Leaving a contract early can cost thousands.

Part 5: Industry-Specific Recommendations

Not all software fits all industries. Based on our invoice factoring software reviews, here is the breakdown:

| Industry | Recommended Tool | Why? |

| Marketing Agency | Fundbox | Fast, private integration. |

| Staffing Firm | AltLINE | Handles payroll volume. |

| Trucking | eCapital | Fuel advances & bills of lading. |

| Construction | BlueVine | Higher limits for materials. |

Part 6: Factoring vs. Bank Loans vs. AI Automation

Before signing up based on these invoice factoring software reviews, ask yourself: Do you have a cash flow problem, or a collections problem?

- Scenario A (Cash Flow Issue): You need cash now to buy inventory. Factoring is the solution.

- Scenario B (Collections Issue): Clients are paying late because you aren’t chasing them.

- Solution: Automated Collections (AI).

- Note: While tools like Fundbox fix the cash gap for a fee, automating your invoice chasing using AI tools can often speed up payments by 30% for free.

Conclusion: Which Software Should You Choose?

In 2026, liquidity is survival. We hope these invoice factoring software reviews help you make an informed decision.

- If you need Speed, choose Fundbox.

- If you need High Limits, choose BlueVine.

- If you are in Trucking, choose eCapital.

Always read the fee schedule twice. The cheapest rate isn’t always the best deal if it comes with hidden wire fees.

Still unsure?

Check out our detailed factoring fees comparison guide or consult a financial advisor before signing.

Need to improve cash flow without borrowing? [Contact Vsurgemedia] to build a custom AI Automation Engine that chases invoices and gets you paid faster automatically.