Vsurgemedia | Expense tracking software for freelancers

You’re Probably Losing Money — And It’s Not Your Fault

Most Expense tracking software freelancers don’t realize how much money they’re leaving on the table until tax season hits. Lost receipts, uncategorized transactions, and inaccurate spreadsheets can erase thousands of dollars in deductions. And with stricter IRS 1099-K reporting in 2026, there’s even less margin for error. The right software stops this pain immediately—automatically tracking expenses, reading receipts through OCR, and preparing deduction-ready reports. In this guide, you’ll discover the best expense tracking software built specifically to protect freelancers from financial leaks.

If you’re a US-based freelancer looking for the best expense tracking software in 2026, here are the top three options based on price, automation, and IRS compliance:

- QuickBooks Self-Employed — $15/month

- Auto-categorizes expenses, tracks mileage, maximizes Schedule C deductions

- FreshBooks Lite — $19/month

- Combines invoicing, time tracking, and project-based expense management

- Wave Accounting — $0

- Free bank syncing, receipt scanning, unlimited expense categories

Quick pick:

Choose QuickBooks SE if taxes overwhelm you. Pick FreshBooks if you invoice clients often. Choose Wave if you’re budget-limited.

2025–2026 urgency:

IRS audits for freelancers are increasing due to 1099-K policy changes—clean expense documentation dramatically reduces stress, penalties, and tax overpayment.

⭐COMPARISON TABLE

| Solution | Price / Mo | Best For | Key Features | Rating | Free Trial |

| QuickBooks Self-Employed | 🟢 $15 | Tax-focused freelancers | Auto-categorization, mileage tracking, receipt capture, Schedule C reports | ⭐ 4.7 | 30 days |

| FreshBooks Lite | 🔵 $19 | Service freelancers | Invoicing, time tracking, project expenses, mobile receipts | ⭐ 4.6 | 30 days |

| Wave Accounting | 🟢 $0 | Beginners | Receipt scanning, bank sync, categorization, export to CSV | ⭐ 4.5 | Free |

| Xero Starter | 🟡 $15* | Multi-client freelancers | Bank feeds, rules engine, mobile expenses, basic accounting | ⭐ 4.4 | 30 days |

| Zoho Books Standard | 🟡 $20 | Automation seekers | Receipt OCR, workflows, multi-currency, client portal | ⭐ 4.6 | 14 days |

| Bonsai Workflow | 🔵 $17 | Agencies / Creatives | Contracts + invoices + expenses, time tracking | ⭐ 4.5 | 7 days |

| Expensify Track Plan | 🟢 $5 | Receipt-heavy users | SmartScan OCR, auto-categorization, IRS-compliant exports | ⭐ 4.3 | Free tier |

⭐UNDERSTANDING THE NEED

Picture this:

You’re a freelance video editor in Denver, juggling multiple clients. You buy a new SSD, upgrade software, grab coffee during client meetings, pay for rides, and book coworking space access. At tax season, you dig through emails, bank statements, receipts, and PayPal logs—realizing half the expenses are missing or uncategorized.

This is the reality for most freelancers.

The Hidden Problem

Freelancers often believe they’re “tracking expenses”—but in reality, they are:

- Guessing categories

- Forgetting deductions

- Missing receipts

- Using spreadsheets with human errors

- Mixing personal + business spending

- Scrambling during tax time

The average US freelancer loses $1,200 to $4,000/year in missed tax deductions simply because expenses aren’t tracked correctly.

What Freelancers Actually Need (Non-Negotiables)

Your expense tracking software must include:

- Automatic bank syncing — manual entry = mistakes

- Receipt OCR scanning — to reduce lost receipts

- IRS-compliant categories — especially for Schedule C

- Tax estimation — quarterly payments are unavoidable

- Mobile-first capture — freelancers are rarely at a desk

- Export-ready reports — for CPAs or TurboTax

Why It’s Critical in 2026

As of January 2026, new IRS 1099-K rules mean:

- PayPal, Venmo, Stripe, Etsy, and gig platforms must report all transactions above $600.

- More freelancers are receiving tax notices.

- Deductions must be supported by clean, well-documented expense logs.

AI-powered expense tools now auto-read receipt text, detect vendors, assign categories, and flag duplicate transactions—reducing manual work by up to 12 hours/month.

⭐THE DEEP DIVE

Below are the 7 best expense tracking solutions, each broken down using your precise structure.

1. QuickBooks Self-Employed

Positioning: Best for freelancers focused on tax optimization and IRS compliance.

💰 Pricing

- $15/month

- $25/month with TurboTax bundle

⭐ Rating + Best For

- Rating: 4.7/5

- Best For: Freelancers who want maximum Schedule C tax deductions

📝 Overview

QuickBooks SE is a purpose-built tool for self-employed Americans, focusing heavily on ensuring every tax-deductible expense is tracked and categorized properly.

🔑 Key Features

- Auto-categorization using IRS-compliant rules

- GPS miles tracking (saves $0.67/mile in deductions)

- OCR-based receipt capture

- Quarterly tax estimation

- Schedule C reporting and export

💵 Pricing Breakdown

- Base plan: $15

- QB SE + TurboTax bundle: $25

- No storage limits

- Unlimited receipts

✅ Pros

- Saves freelancers an average of $2,000/year in deductions

- Best-in-class tax features

- Easy automation rules

❌ Cons

- Weak invoicing system

- Not ideal for multi-client tagging

- UI feels basic

🏢 Real-World Use Case

A freelance developer in Seattle switched to QBSE and reduced tax prep time from 10 hours to 2 hours/month.

🔎 Bottom Line

Choose if: Tax optimization is your priority.

Skip if: You want invoicing + expenses in one tool.

2. FreshBooks Lite

Positioning: For client-heavy freelancers who need invoicing + expenses.

Pricing

- $19/month

Rating + Best For

- Rating: 4.6/5

- Best For: Service providers (writers, consultants, marketers)

Overview

FreshBooks integrates client billing, time tracking, and expense tracking into a single platform—ideal for freelancers who send many invoices.

Key Features

- Auto import expenses from bank feeds

- Project-based expense grouping

- Time tracking integrated with billing

- Client portal

- Late payment automation

Pricing Breakdown

- Lite: $19/month

- Plus (for growing freelancers): $33/month

Pros

- Easiest invoicing in the market

- Intuitive interface

- Clean mobile app

Cons

- More expensive than alternatives

- Automation limited compared to QBSE

- No built-in tax estimation

Use Case

A marketing freelancer in Miami improved late-payment compliance by 60% using FreshBooks reminders.

Bottom Line

Choose if: You invoice clients frequently.

Skip if: You need deep automation or tax estimates.

3. Wave Accounting

Positioning: Best free expense tracker with robust features.

Pricing

- $0/month

Rating + Best For

- Rating: 4.5/5

- Best For: New freelancers and budget-conscious users

Overview

Wave provides free expense tracking with unlimited receipts and bank syncing. Great for early-stage freelancers not ready for monthly software fees.

Key Features

- OCR receipt scanning

- Automatic categorization

- Profit & loss statements

- Bank feed imports

- Unlimited categories

Pricing Breakdown

- Free core features

- Payment processing (optional): 2.9% + $0.60

- Payroll: $20/month

Pros

- 100% free

- Great mobile receipts app

- Simple interface

Cons

- No advanced rules

- No tax estimation

- Customer support is limited

Use Case

A new Etsy seller in Phoenix used Wave to track receipts and stay audit-safe at zero cost.

Bottom Line

Choose if: You’re starting out or need zero-cost tools.

Skip if: You need automation or quarterly tax forecasting.

4. Xero Starter

Positioning: Best for freelancers with multiple clients and recurring expenses.

Pricing

- $15/month

Rating + Best For

- Rating: 4.4

- Best For: Freelancers with multi-client workflows

Overview

Xero offers strong automation through bank rules and is ideal for freelancers who need deeper reporting.

Key Features

- Rules-based expense categorization

- Expense claims mobile app

- Bank reconciliation

- Light invoicing

- Detailed reporting

Pricing Breakdown

- Starter: $15

- Standard: $37

- Premium: $47

Pros

- Strong automation

- Excellent reporting

- Smooth bank feed imports

Cons

- Learning curve

- Limited invoicing in Starter plan

- Price jumps quickly

Use Case

A photographer in Dallas reduced manual entry by 80% after setting up bank rules.

Bottom Line

Choose if you want flexible automation. Skip if you want simplicity.

5. Zoho Books Standard

Positioning: Best automation and workflow flexibility.

Pricing

- $20/month

Rating + Best For

- Rating: 4.6

- Best For: Automation-heavy freelancers

Overview

Zoho Books is highly automated, linking receipts, workflows, client projects, and tagging.

Key Features

- OCR receipt processing

- Workflow automation

- Multi-currency support

- Client portal

- Bank rules

Pricing Breakdown

- Standard: $20

- Professional: $50

Pros

- Automation powerhouse

- Scales with your business

- Great client communication tools

Cons

- Overkill for beginners

- More complex interface

- No integrated tax estimation

Use Case

A freelance consultant in Boston automated recurring expenses and saved 10 hours/month.

Bottom Line

Choose if you love automation. Skip if you’re non-technical.

6. Bonsai Workflow

Positioning: Best all-in-one workflow + expense system.

Pricing

- $17/month

Rating + Best For

- Rating: 4.5

- Best For: Creative freelancers (designers, agencies)

Overview

Bonsai brings contracts, proposals, tasks, expenses, and invoices into a single dashboard.

Key Features

- All-in-one freelancing suite

- Expense matching with projects

- Contract templates

- Task management

- Client CRM

Pricing Breakdown

- Starter: $17

- Professional: $32

Pros

- Great for agencies

- Clean UI

- Centralized workflow

Cons

- Not as accounting-focused

- Expense features less advanced

- Price jumps fast

Use Case

A digital studio in Los Angeles saved time by consolidating 4 tools into Bonsai.

Bottom Line

Choose if you want a full workflow system. Skip if you only need expenses.

7. Expensify Track Plan

Positioning: Best for receipt-heavy freelancers.

Pricing

- $5/month

Rating + Best For

- Rating: 4.3

- Best For: Freelancers with many receipts

Overview

Expensify focuses primarily on receipts using powerful SmartScan OCR.

Key Features

- 100% OCR smart scan

- Auto-categorization rules

- Export to CSV / PDF / Excel

- IRS-ready logs

- Mobile-first

Pricing Breakdown

- Track Plan: $5

- Collect: $10

Pros

- Best OCR on the market

- Easy to use

- Affordable

Cons

- Minimal accounting features

- No tax estimation

- Basic reporting

Use Case

A rideshare freelancer in New York logs 300+ receipts monthly with 98% accuracy.

Bottom Line

Choose if receipts overwhelm you. Skip if you need full accounting.

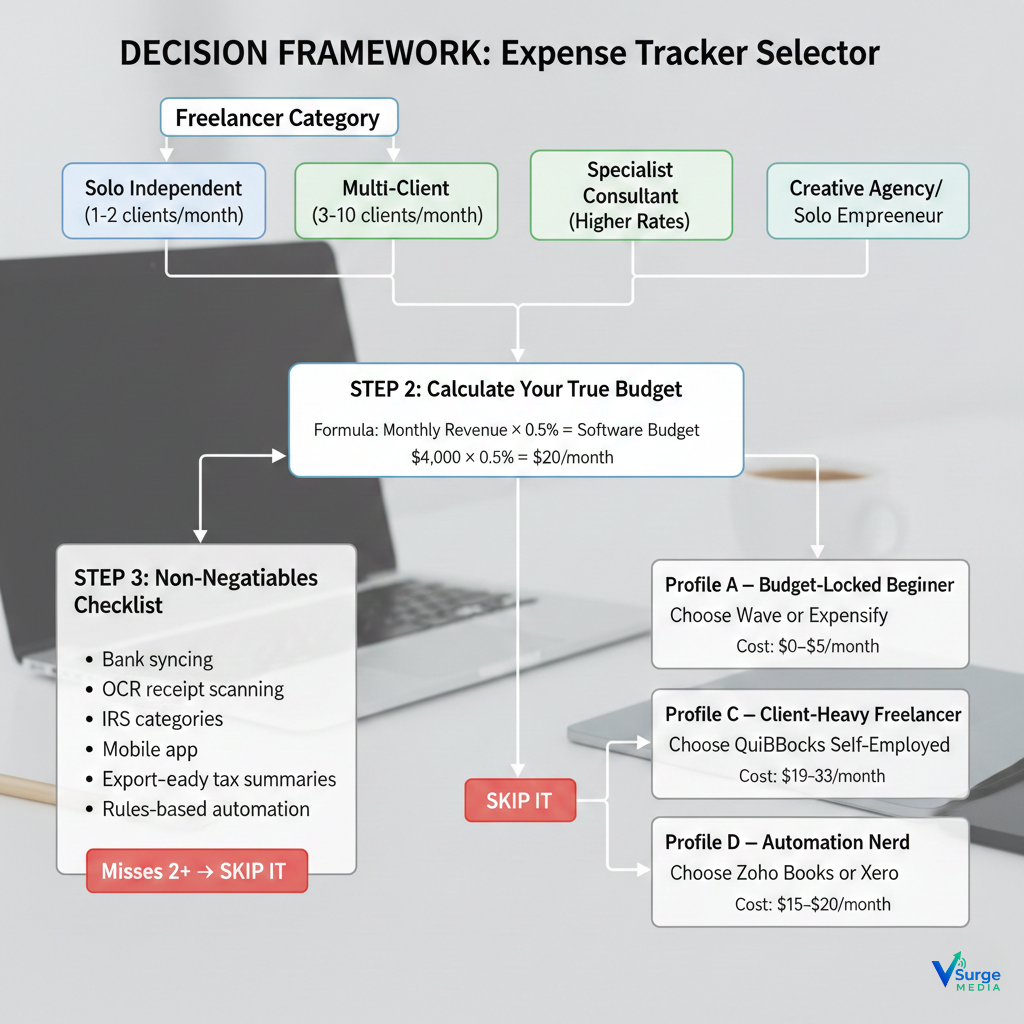

DECISION FRAMEWORK

Here’s a 60-second tool for choosing the right expense tracker:

STEP 1: Identify Your Freelancer Category

Which describes you?

- Solo independent freelancer (1–2 clients/month)

- Multi-client freelancer (3–10 clients/month)

- Specialist consultant (higher rates)

- Creative agency/solo entrepreneur

STEP 2: Calculate Your True Budget

Use this formula:

Monthly freelance revenue × 0.5% = ideal software budget

Example:

$4,000 revenue × 0.5% = $20/month budget

STEP 3: Your Non-Negotiables Checklist

You should require software with:

- Bank syncing

- OCR receipt scanning

- IRS categories

- Mobile app

- Export-ready monthly tax summaries

- Mileage logging

- Rules-based automation

If a tool misses 2 of these → Skip it.

STEP 4: Match Yourself to a Profile

Profile A — Budget-Locked Beginner

Choose Wave or Expensify

Cost: $0–$5/month

Profile B — Tax-Focused Pro

Choose QuickBooks Self-Employed

Cost: $15/month

Profile C — Client-Heavy Freelancer

Choose FreshBooks

Cost: $19–$33/month

Profile D — Automation Nerd

Choose Zoho Books or Xero

Cost: $15–$20/month

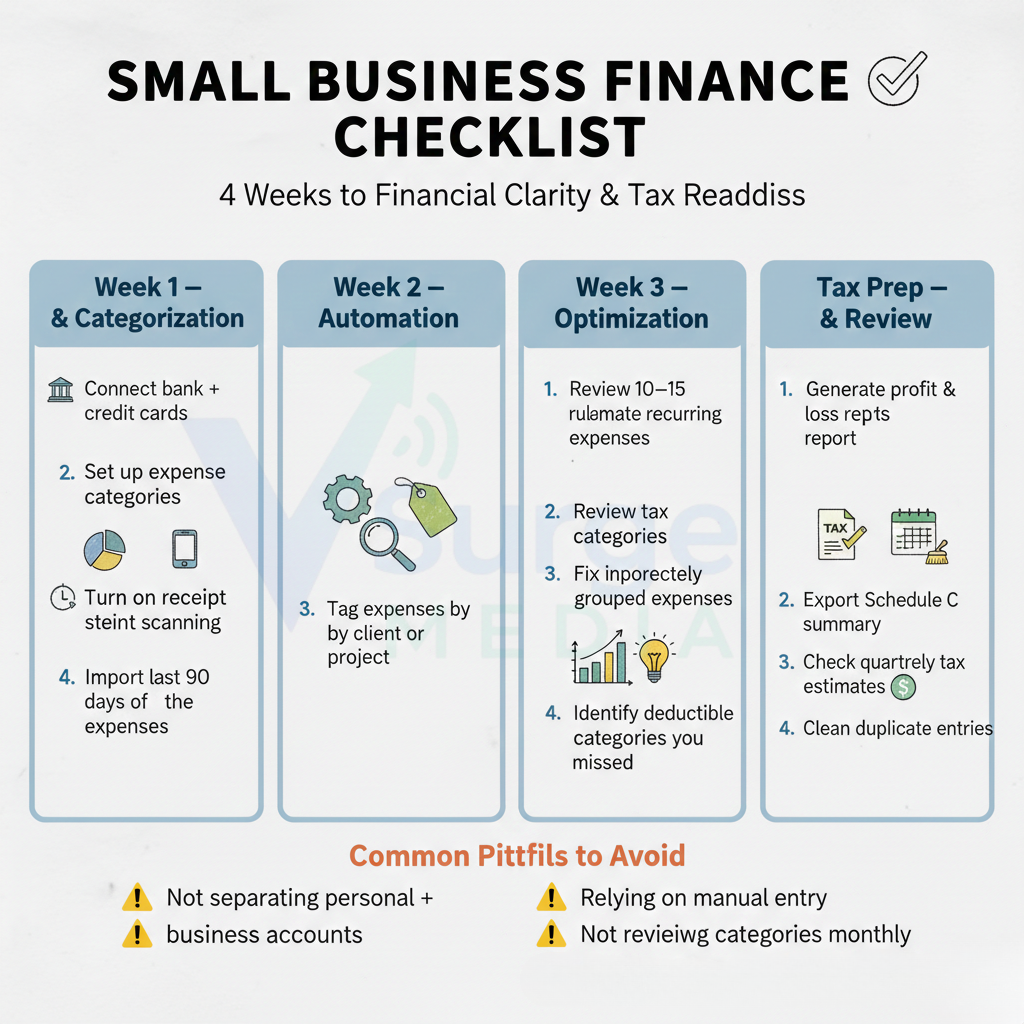

⭐IMPLEMENTATION ROADMAP

Week 1 — Setup & Categorization

- Connect bank + credit cards

- Set up expense categories

- Turn on receipt scanning

- Import last 90 days of expenses

Week 2 — Automation

- Create 10–15 bank rules

- Automate recurring expenses

- Tag expenses by client or project

Week 3 — Optimization

- Review tax categories

- Fix incorrectly grouped expenses

- Generate monthly report

- Identify deductible categories you missed

Week 4 — Tax Prep & Review

- Generate profit & loss report

- Export Schedule C summary

- Check quarterly tax estimates

- Clean duplicate entries

Common Pitfalls to Avoid

⚠️ Not separating personal + business accounts

⚠️ Relying on manual entry

⚠️ Not reviewing categories monthly

⚠️ Ignoring mileage deductions (worth $0.67/mile)

⭐COST-BENEFIT ANALYSIS

Cost of Doing Nothing

Most freelancers lose:

- $1,200–$4,000/year in missed deductions

- 80+ hours/year tracking finances manually

- Pay $300–$900 extra in IRS penalties during audits

Investment in Software

Average cost: $0–$20/month

If expense tracking saves even $2,000/year, ROI is:

→ 600%–1200% return

Break-Even Point

If the software saves:

$170/month in deductions,

your subscription cost is recovered in the first week.

⭐FAQ

1. What’s the cheapest option?

Wave ($0). Expensify ($5) if you need receipt scanning.

2. Do expensive tools give better results?

Yes—QuickBooks SE and FreshBooks offer automation, which saves hours monthly.

3. How long does it take to implement?

About 1–2 hours to fully set up your account and bank feeds.

4. What if I switch tools later?

All tools export data via CSV/PDF—switching is easy.

5. Are there hidden fees?

Only for:

- Payment processing

- Payroll add-ons

- Premium upgrades

6. Is tax compliance included?

QuickBooks SE has the best IRS compliance tools.

7. What’s the biggest mistake freelancers make?

Mixing personal + business expenses—not separating accounts causes audits.

8. Will these tools help during an IRS audit?

Yes—they maintain clean, timestamped receipts and categorized logs.

9. Do these tools work on mobile?

All seven support iOS + Android.

10. Which software is best for creative agencies?

Bonsai or Zoho Books.

⭐CONCLUSION + ACTION

Choosing the right expense tracking software is one of the highest-ROI decisions a freelancer can make. Whether you want tax savings, automation, or client-based expense tracking, one of the seven tools above will fit your workflow perfectly.

3 Action Plans

- Ready to Decide: Choose QuickBooks SE or FreshBooks Lite.

- Need Research: Test Wave and Zoho Books using free trials.

- Budget Blocked: Start with Wave and upgrade when revenue grows.

Updated: January 2026

Best accounting software for freelancers

Freelancer tax deductions guide 2026

Receipt management software for freelancers

#ExpenseTrackingSoftware #FreelancerFinance #SelfEmployedTools #FreelanceBusinessGrowth #FreelancerTaxDeductions #BusinessExpenseTracker #Vsugemedia #FreelancerAccounting #TaxSavings2026 #USABusinessTools #FreelanceMoneyManagement #SmallBusinessTools #DigitalFreelancer #OnlineAccountingSoftware #FinanceAutomation #AIAccountingTools #MoneyManagementApps #SolopreneurLife #FreelanceWorkflow #IndependentContractor #1099IncomeManagement #USTaxCompliance #1099K2025 #ScheduleCReady #USAFreelancers #FreelanceTaxSoftware #FreelancerCFO #USBusinessExpenses #FinanceForFreelancers #CreatorsEconomy #DigitalCreators #EntrepreneurTools #ProductivityStack #WorkSmart2026